Interest rate

| Finance |

|---|

|

Financial markets

Bond market

Stock market (equity market) |

|

Financial instruments

Cash:

Deposit |

|

Structured finance

Capital budgeting |

|

Personal finance

Credit and debt

Student financial aid |

|

Government spending:

Transfer payment |

|

|

|

Financial regulation

Finance designations

Accounting scandals |

|

Standards

ISO 31000

International Financial Reporting |

|

Economic history

Stock market bubble

Recession |

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower. Interests rates are fundamental to a capitalist society. Interest rates are normally expressed as a percentage rate over the period of one year.

Interest rates targets are also a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment.

Contents |

Historical interest rates

In the past two centuries, interest rates have been variously set either by national governments or central banks. For example, the Federal Reserve federal funds rate in the United States has varied between about 0.25% to 19% from 1954 to 2008, while the Bank of England base rate varied between 0.5% and 15% from 1989 to 2009,[1][2] and Germany experienced rates close to 90% in the 1920s down to about 2% in the 2000s.[3][4] During an attempt to tackle spiraling hyperinflation in 2007, the Central Bank of Zimbabwe increased interest rates for borrowing to 800%.[5]

The interest rates on prime credits in the late 1970s and early 1980s were far higher than had been recorded – higher than previous US peaks since 1800, than British peaks since 1700, or than Dutch peaks since 1600; "since modern capital markets came into existence, there have never been such high long-term rates" as in this period.[6]

Reasons for interest rate change

- Political short-term gain: Lowering interest rates can give the economy a short-run boost. Under normal conditions, most economists think a cut in interest rates will only give a short term gain in economic activity that will soon be offset by inflation. The quick boost can influence elections. Most economists advocate independent central banks to limit the influence of politics on interest rates.

- Deferred consumption: When money is loaned the lender delays spending the money on consumption goods. Since according to time preference theory people prefer goods now to goods later, in a free market there will be a positive interest rate.

- Inflationary expectations: Most economies generally exhibit inflation, meaning a given amount of money buys fewer goods in the future than it will now. The borrower needs to compensate the lender for this.

- Alternative investments: The lender has a choice between using his money in different investments. If he chooses one, he forgoes the returns from all the others. Different investments effectively compete for funds.

- Risks of investment: There is always a risk that the borrower will go bankrupt, abscond, or otherwise default on the loan. This means that a lender generally charges a risk premium to ensure that, across his investments, he is compensated for those that fail.

- Liquidity preference: People prefer to have their resources available in a form that can immediately be exchanged, rather than a form that takes time or money to realise.

- Taxes: Because some of the gains from interest may be subject to taxes, the lender may insist on a higher rate to make up for this loss.

Real vs nominal interest rates

The nominal interest rate is the amount, in money terms, of interest payable.

For example, suppose a household deposits $100 with a bank for 1 year and they receive interest of $10. At the end of the year their balance is $110. In this case, the nominal interest rate is 10% per annum.

The real interest rate, which measures the purchasing power of interest receipts, is calculated by adjusting the nominal rate charged to take inflation into account. (See real vs. nominal in economics.)

If inflation in the economy has been 10% in the year, then the $110 in the account at the end of the year buys the same amount as the $100 did a year ago. The real interest rate, in this case, is zero.

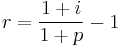

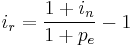

After the fact, the 'realized' real interest rate, which has actually occurred, is given by the Fisher equation, and is

where p = the actual inflation rate over the year. The linear approximation

is widely used.

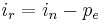

The expected real returns on an investment, before it is made, are:

where:

= nominal interest rate

= nominal interest rate = real interest rate

= real interest rate = expected or projected inflation over the year

= expected or projected inflation over the year

Market interest rates

There is a market for investments which ultimately includes the money market, bond market, stock market and currency market as well as retail financial institutions like banks.

Exactly how these markets function is a complex question. However, economists generally agree that the interest rates yielded by any investment take into account:

- The risk-free cost of capital

- Inflationary expectations

- The level of risk in the investment

- The costs of the transaction

This rate incorporates the deferred consumption and alternative investments elements of interest.

Inflationary expectations

According to the theory of rational expectations, people form an expectation of what will happen to inflation in the future. They then ensure that they offer or ask a nominal interest rate that means they have the appropriate real interest rate on their investment.

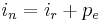

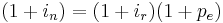

This is given by the formula:

where:

= offered nominal interest rate

= offered nominal interest rate = desired real interest rate

= desired real interest rate = inflationary expectations

= inflationary expectations

Risk

The level of risk in investments is taken into consideration. This is why very volatile investments like shares and junk bonds have higher returns than safer ones like government bonds.

The extra interest charged on a risky investment is the risk premium. The required risk premium is dependent on the risk preferences of the lender.

If an investment is 50% likely to go bankrupt, a risk-neutral lender will require their returns to double. So for an investment normally returning $100 they would require $200 back. A risk-averse lender would require more than $200 back and a risk-loving lender less than $200. Evidence suggests that most lenders are in fact risk-averse.

Generally speaking a longer-term investment carries a maturity risk premium, because long-term loans are exposed to more risk of default during their duration.

Liquidity preference

Most investors prefer their money to be in cash than in less fungible investments. Cash is on hand to be spent immediately if the need arises, but some investments require time or effort to transfer into spendable form. This is known as liquidity preference. A 1-year loan, for instance, is very liquid compared to a 10-year loan. A 10-year US Treasury bond, however, is liquid because it can easily be sold on the market.

A market interest-rate model

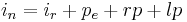

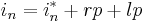

A basic interest rate pricing model for an asset

Assuming perfect information, pe is the same for all participants in the market, and this is identical to:

where

- in is the nominal interest rate on a given investment

- ir is the risk-free return to capital

- i*n = the nominal interest rate on a short-term risk-free liquid bond (such as U.S. Treasury Bills).

- rp = a risk premium reflecting the length of the investment and the likelihood the borrower will default

- lp = liquidity premium (reflecting the perceived difficulty of converting the asset into money and thus into goods).

Interest rate notations

What is commonly referred to as the interest rate in the media is generally the rate offered on overnight deposits by the Central Bank or other authority, annualised.

The total interest on an investment depends on the timescale the interest is calculated on, because interest paid may be compounded.

In finance, the effective interest rate is often derived from the yield, a composite measure which takes into account all payments of interest and capital from the investment.

In retail finance, the annual percentage rate and effective annual rate concepts have been introduced to help consumers easily compare different products with different payment structures.

Money market mutual funds quote their rate of interest as the 7 Day SEC Yield.

Interest rates in macroeconomics

Output and unemployment

Interest rates are the main determinant of investment on a macroeconomic scale. Broadly speaking, if interest rates increase across the board, then investment decreases, causing a fall in national income.

A government institution, usually a central bank, can lend money to financial institutions to influence their interest rates as the main tool of monetary policy. Usually central bank interest rates are lower than commercial interest rates since banks borrow money from the central bank then lend the money at a higher rate to generate most of their profit.

By altering interest rates, the government institution is able to affect the interest rates faced by everyone who wants to borrow money for economic investment. Investment can change rapidly in response to changes in interest rates and the total output.

Open Market Operations in the United States

The Federal Reserve (often referred to as 'The Fed') implements monetary policy largely by targeting the federal funds rate. This is the rate that banks charge each other for overnight loans of federal funds, which are the reserves held by banks at the Fed. Open market operations are one tool within monetary policy implemented by the Federal Reserve to steer short-term interest rates. Using the power to buy and sell treasury securities.

Money and inflation

Loans, bonds, and shares have some of the characteristics of money and are included in the broad money supply.

By setting i*n, the government institution can affect the markets to alter the total of loans, bonds and shares issued. Generally speaking, a higher real interest rate reduces the broad money supply.

Through the quantity theory of money, increases in the money supply lead to inflation.

Mathematical note

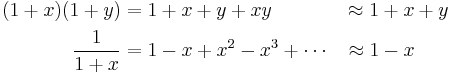

Because interest and inflation are generally given as percentage increases, the formulae above are (linear) approximations.

For instance,

is only approximate. In reality, the relationship is

so

The two approximations, eliminating higher order terms, are:

The formulae in this article are exact if logarithms of indices are used in place of rates.

Negative interest rates

Interest rates are usually positive, but not always. Given the alternative of holding cash (thus earning 0%) rather than lending it out, profit-seeking lenders will not lend below 0%, as they will guarantee a loss, and a bank offering a negative deposit rate will find few takers, as savers will instead hold cash.[7]

However, central bank rates can be negative; in July 2009 Sweden's Riksbank was the first central bank to use negative interest rates, lowering its deposit rate to −0.25%, a policy advocated by deputy governor Lars E. O. Svensson.[8] This negative interest rate is possible because Swedish banks, as regulated companies, must hold these reserves with the central bank – they do not have the option of holding cash.

Negative interest rates have been proposed in the past, notably in the late 19th century by Silvio Gesell.[9] A negative interest rate can be described (as by Gesell) as a "tax on holding money"; he proposed it as the Freigeld (free money) component of his Freiwirtschaft (free economy) system. To prevent people from holding cash (and thus earning 0%), Gesell suggested issuing money for a limited duration, after which it must be exchanged for new bills – attempts to hold money thus result in it expiring and becoming worthless.

External links

You can see a list of current interest rates at these sites:

Notes

- ↑ moneyextra.com Interest Rate History. Retrieved 2008-10-27

- ↑ news.bbc.co.uk UK interest rates lowered to 0.5%

- ↑ (Homer, Sylla & Sylla 1996, p. 509)

- ↑ Bundesbank. BBK - Statistics - Time series database. Retrieved 2008-10-27

- ↑ worldeconomies.co.uk Zimbabwe currency revised to help inflation

- ↑ (Homer, Sylla & Sylla 1996, p. 1)

- ↑ Buiter, Willem (2009-05-07), Negative interest rates: when are they coming to a central bank near you?, Financial Times, http://blogs.ft.com/maverecon/2009/05/negative-interest-rates-when-are-they-coming-to-a-central-bank-near-you/

- ↑ Ward, Andrew; Oakley, David (2009-08-27), Bankers watch as Sweden goes negative, Financial Times, http://www.ft.com/cms/s/0/5d3f0692-9334-11de-b146-00144feabdc0.html

- ↑ Mankiw, Gregory (2009-04-18), It May Be Time for the Fed to Go Negative, New York Times, http://www.nytimes.com/2009/04/19/business/economy/19view.html

- Homer, Sidney; Sylla, Richard Eugene; Sylla, Richard (1996), A History of Interest Rates, Rutgers University Press, ISBN 978-0-81352288-3, http://books.google.it/books?id=w3hmC17-em4C&hl=en, retrieved 2008-10-27

See also

- Rate of return on investment

- Central bank

- Discount rate

- Finance

- Interest

- Macroeconomics

- Monetary policy

- Real interest rate

- Short rate model

|

|||||||||||||||||||||||||